As a small business, raising enough capital for your organisation remains to be a major issue. Due to lack of experience, many businesses have limited knowledge of the array of options available to raise funds.

In today’s article, we discuss the basic elements of raising capital for your business so that you too are able to find sufficient capital to pursue your goals.

1. Prepare Yourself For the Future

It is crucial to prepare for sourcing for the funding you need. Although this step is frequently overlooked, you have to ensure that you examine and address multiple dimensions of your business in order to ensure that it is ready overall. Failure to do so will result in the constant transfer of sufficient resources to run your business. You will have to assess your team’s overall health, conduct research on your industry, competitors and the market, define your products, prepare financial projections, and find out the amount if capital to raise, as well as decide if you want to rely on debt or equity.

Although the preparation step is rather time consuming, it will be much easier to figure out whom to target if you are sure of what you want and outline the rationale behind your options.

2. Conduct Research on the Different Types of Investors

3. Network and Source for Potential Investors

4. Look For Companies That Offer Funding in Your Niche

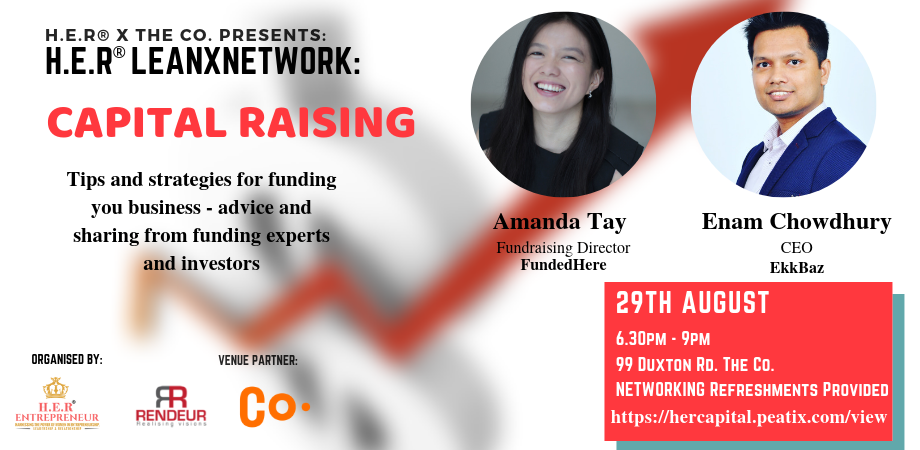

If you would like to learn more about how to maximize one’s opportunities to raise capital and source for the right venture capitalist, do join us in our next LearnXNetwork event happening tomorrow, on 29th August 2019.

For more information, do visit our event page: https://hercapital.peatix.com/